Complete Guide to Volume Weighted Average Price (VWAP) – Strategies & Advanced Techniques

📌 What is VWAP?

VWAP (Volume Weighted Average Price) is a technical indicator that calculates the average price of an asset, adjusted for its traded volume. It is widely used by traders to identify trends, entry/exit points, and institutional activity.

👉 Key Uses of VWAP:

- Determines intraday trend direction 📈📉

- Helps institutions execute large orders efficiently

- Acts as a dynamic support and resistance level

📊 How to Calculate VWAP

VWAP is calculated using the formula:

Where:

- Price = (High + Low + Close) / 3 (Typical Price)

- Volume = Number of shares/contracts traded

✅ Example Calculation:

- Suppose we have the following price and volume data:

| Time | High | Low | Close | Volume |

|---|---|---|---|---|

| 9:30 | 100 | 98 | 99 | 500 |

| 9:31 | 102 | 99 | 101 | 700 |

| 9:32 | 103 | 101 | 102 | 800 |

Compute the typical price for each period:

Compute VWAP iteratively using price and volume.

🔥 Best VWAP Trading Strategies

1️⃣ VWAP as Dynamic Support & Resistance

- Buy when price pulls back to VWAP in an uptrend

- Sell when price retraces to VWAP in a downtrend

2️⃣ VWAP Breakout Strategy

- BUY: When the price breaks above VWAP with strong volume.

- SELL: When the price drops below VWAP with high selling pressure.

3️⃣ VWAP + Moving Average Confluence

- Use VWAP with 50 EMA to confirm trends.

- BUY when VWAP is above 50 EMA and both are sloping upwards.

- SELL when VWAP is below 50 EMA and both are sloping downwards.

4️⃣ VWAP Standard Deviation Bands

- Similar to Bollinger Bands but based on VWAP.

- BUY near lower band & SELL near upper band when price reverts.

📈 Advanced VWAP Techniques

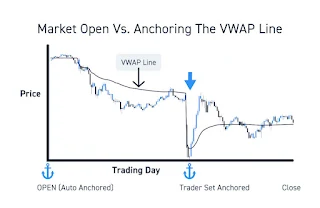

🔹 Anchored VWAP

- Attaches VWAP to a specific point (e.g., earnings, news events, significant highs/lows).

- Useful for identifying key supply & demand zones.

🔹 Multi-Day VWAP for Swing Trading

- Instead of resetting daily, 5-day or 10-day VWAP gives a broader trend.

- Helps swing traders in defining key trend levels.

🔹 VWAP with Order Flow Analysis

- Use VWAP alongside volume profile to see where institutions are buying/selling.

- BUY when price reclaims VWAP with rising order flow.

⏳ Best Timeframes for VWAP

📌 Intraday Traders: 1-min, 5-min, 15-min charts

📌 Swing Traders: Multi-day VWAP (5D, 10D)

📌 Long-Term Traders: Anchored VWAP on weekly/monthly levels

🎯 Stop-Loss & Target Placement

✅ Stop-Loss: Below VWAP for long trades, above VWAP for short trades.

✅ Target Placement: Previous swing highs/lows or 1.5x risk-reward ratio.

🚀 Final Thoughts on VWAP

✅ VWAP is ideal for trend confirmation & institutional activity tracking.

✅ Best when combined with volume analysis, EMAs, & order flow tools.

✅ Avoid trading against VWAP in strong trends!

💡 Bonus Tip: Use Anchored VWAP to identify accumulation & distribution zones.

📢 Do you use VWAP in your trading? Share your thoughts in the comments! 🚀

Meta Description: Learn everything about Volume Weighted Average Price (VWAP) in trading. Discover how to calculate it, strategies to use, and advanced tips to maximize your profits. Perfect for stocks, forex, and indices!